With great pleasure, we will explore the intriguing topic related to Best Target Date Funds 2050: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Target date funds (TDFs) are a popular choice for investors who are saving for retirement. These funds automatically adjust their asset allocation based on the investor’s age and retirement date, making them a convenient and hands-off way to invest.

If you are planning to retire in 2050, a target date fund 2050 (TDF 2050) can be a good option for you. These funds are designed to provide a diversified portfolio of stocks, bonds, and other assets that will help you reach your retirement goals.

Target date funds are typically managed by a professional investment manager. The manager will adjust the fund’s asset allocation over time, becoming more conservative as the investor gets closer to their retirement date. This helps to reduce the risk of losing money in the years leading up to retirement.

The asset allocation of a TDF 2050 will typically be around 90% stocks and 10% bonds when the investor is in their 20s. This allocation will gradually become more conservative over time, until it reaches around 50% stocks and 50% bonds when the investor is in their 50s.

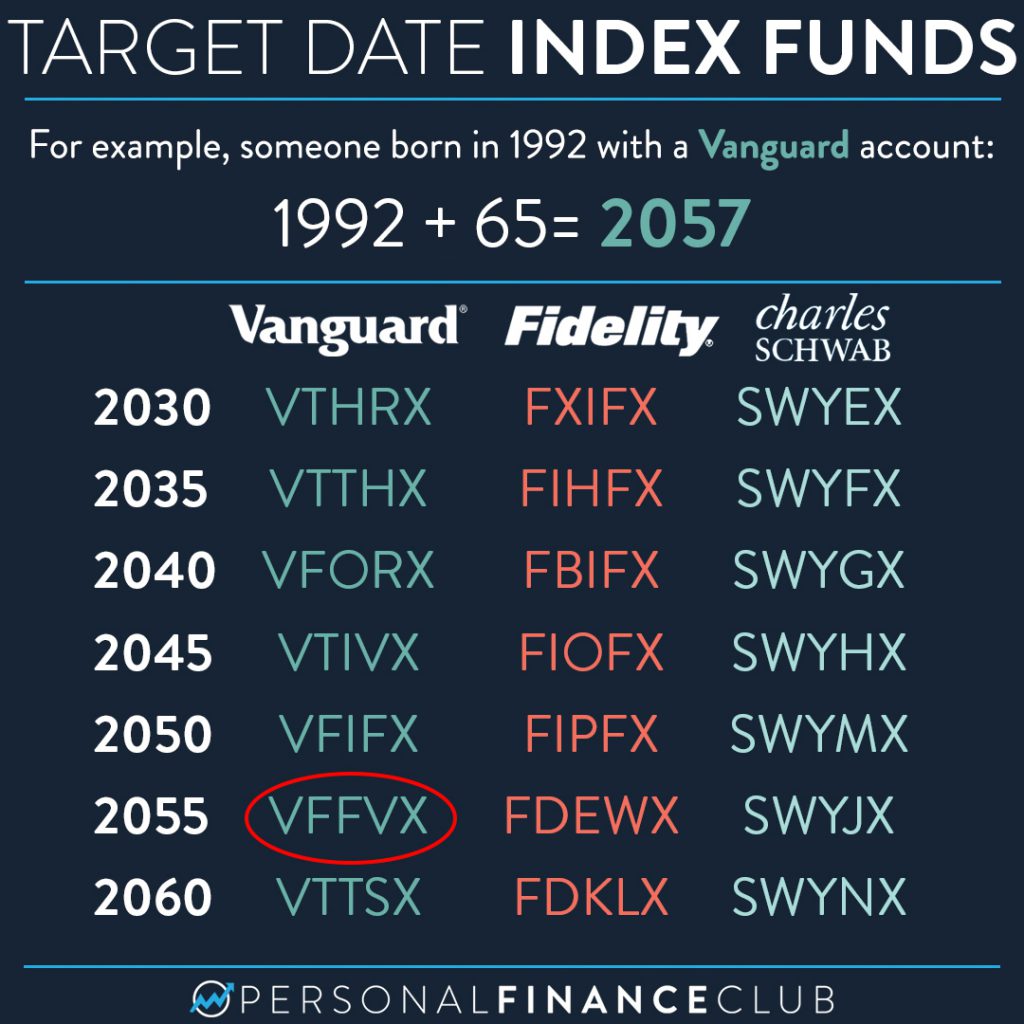

You can invest in a target date fund through a variety of financial institutions, including banks, brokerages, and mutual fund companies. You can also invest directly through the fund company’s website.

When you invest in a target date fund, you will need to choose an account type. The most common account types are individual retirement accounts (IRAs) and 401(k) plans.

Target date funds are a convenient and effective way to invest for retirement. If you are planning to retire in 2050, a TDF 2050 can be a good option for you.

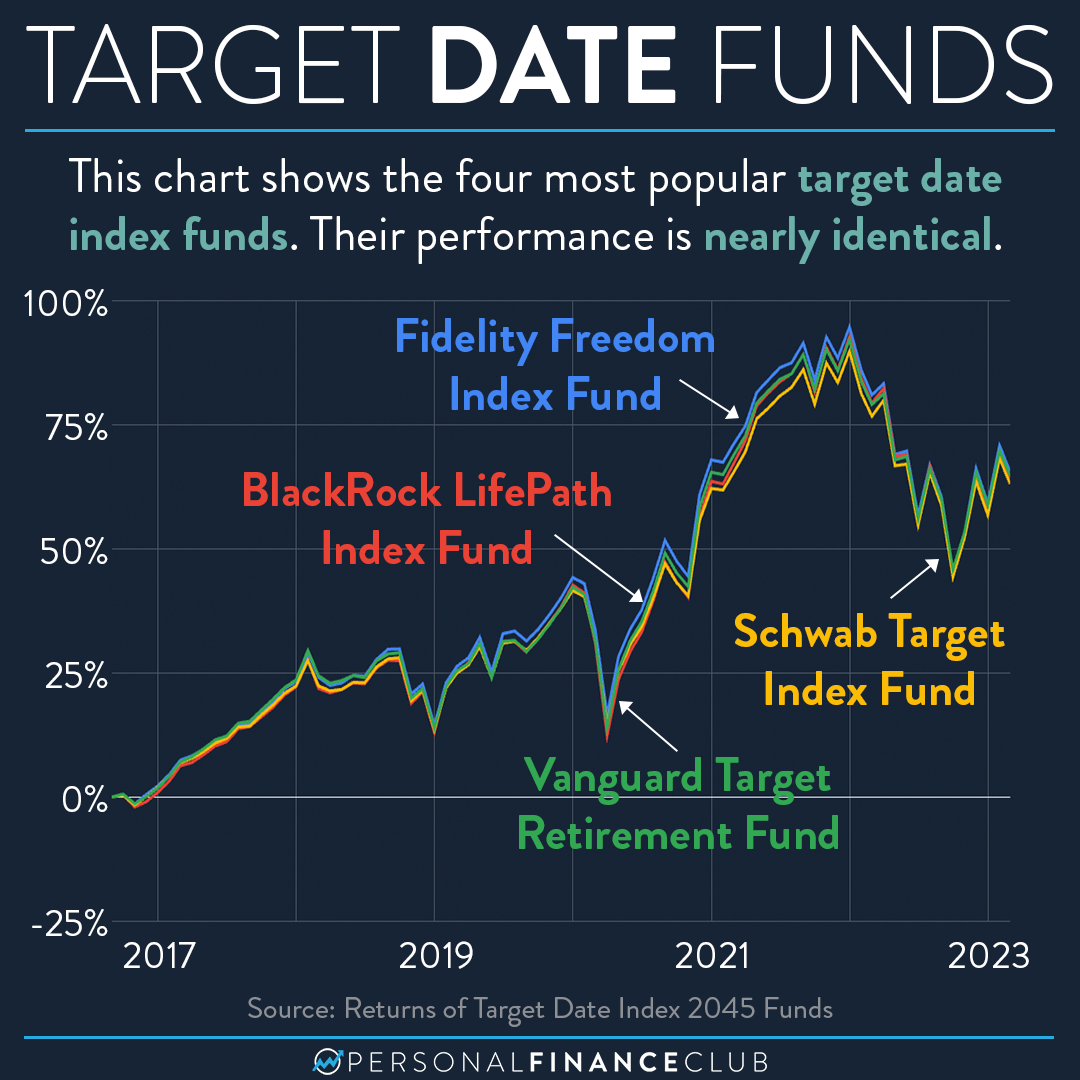

When choosing a TDF, it is important to consider your risk tolerance, investment horizon, and fees. The funds listed above are some of the best target date funds 2050 available.

Thus, we hope this article has provided valuable insights into Best Target Date Funds 2050: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!