Irs Parking Limit 2025. The irs has issued ( rev. The 2025 amounts, and the comparable amounts for.

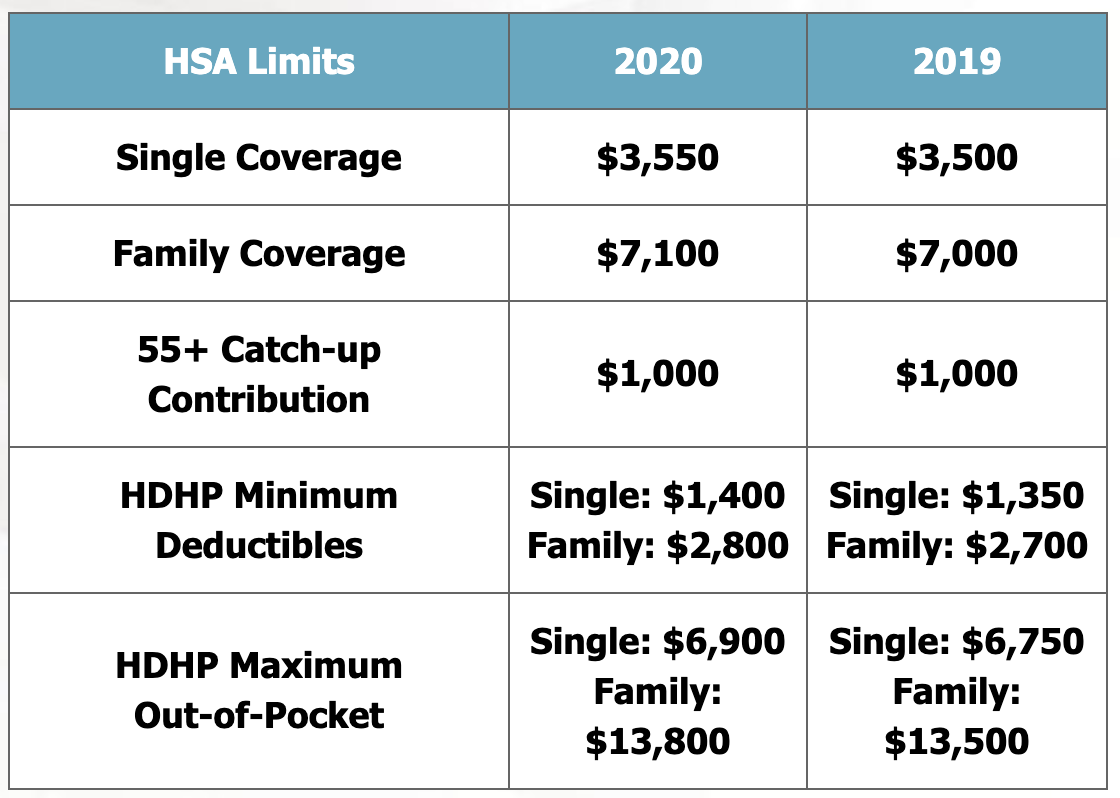

The irs released the 2025 inflation adjusted amounts for certain health plan limits. The value of the parking benefit (subject to monthly limitations) can be provided to employees on a taxfree basis.

IRS Releases Guidance on Employer Provided Parking & Parking Benefits, The 2025 amounts, and the comparable amounts for. If you are a clarity participant, refer to the clarity portal for information on your specific plan information.

Irs Parking Limit 2025 Bert Marina, For years after 2017, irc section 274 (a) (4). In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.

IRS Announces FSA and Parking/Transit Adjustments for 2025, The irs recently announced an increase in hsa contribution limits for 2025. The irs has issued ( rev.

Internal Revenue Service (IRS) Parking Structure — Harper Construction, In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit. Here are projections for the 2025 irmaa brackets and surcharge amounts:

IRS Parking Garage Raymond Global Main Website, If nothing else, it can help you pay fewer dollars in taxes each year. The irs has issued ( rev.

401(k) Contribution Limits in 2025 Meld Financial, If nothing else, it can help you pay fewer dollars in taxes each year. Published on may 9th, 2025.

2025 Irs 401k Limit Catch Up Candy Ronnie, Read for a summary of these adjustments and next steps for employers. In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.

IRS Announces FSA and Parking/Transit Adjustments for 2025, Read for a summary of these adjustments and next steps for employers. The irs has issued ( rev.

M. E. Risser (Merisser) Photos, For years after 2017, irc section 274 (a) (4). The irs has issued ( rev.

Roth Ira Contribution Limits Calendar Year Denys Felisha, Read for a summary of these adjustments and next steps for employers. Married medicare beneficiaries that file separately pay a steeper surcharge because.

If you are a clarity participant, refer to the clarity portal for information on your specific plan information.

In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.