Tesla Model X Section 179 2025. The cost of a vehicle weighing above this. Can i deduct the full model x purchase price?

Brandon tesla has introduced notable changes to the steering wheel design in its 2025 model x, featuring a traditional center horn and a new dedicated. Since the tesla model x is greater than 6000 lbs gvwr, it also qualifies for section 168 which can be far better than section 179.

101 rows crest capital urges all business owners to check with their accountant regarding taxes, deductions, section 179 eligibility, and rules applicable to your business.

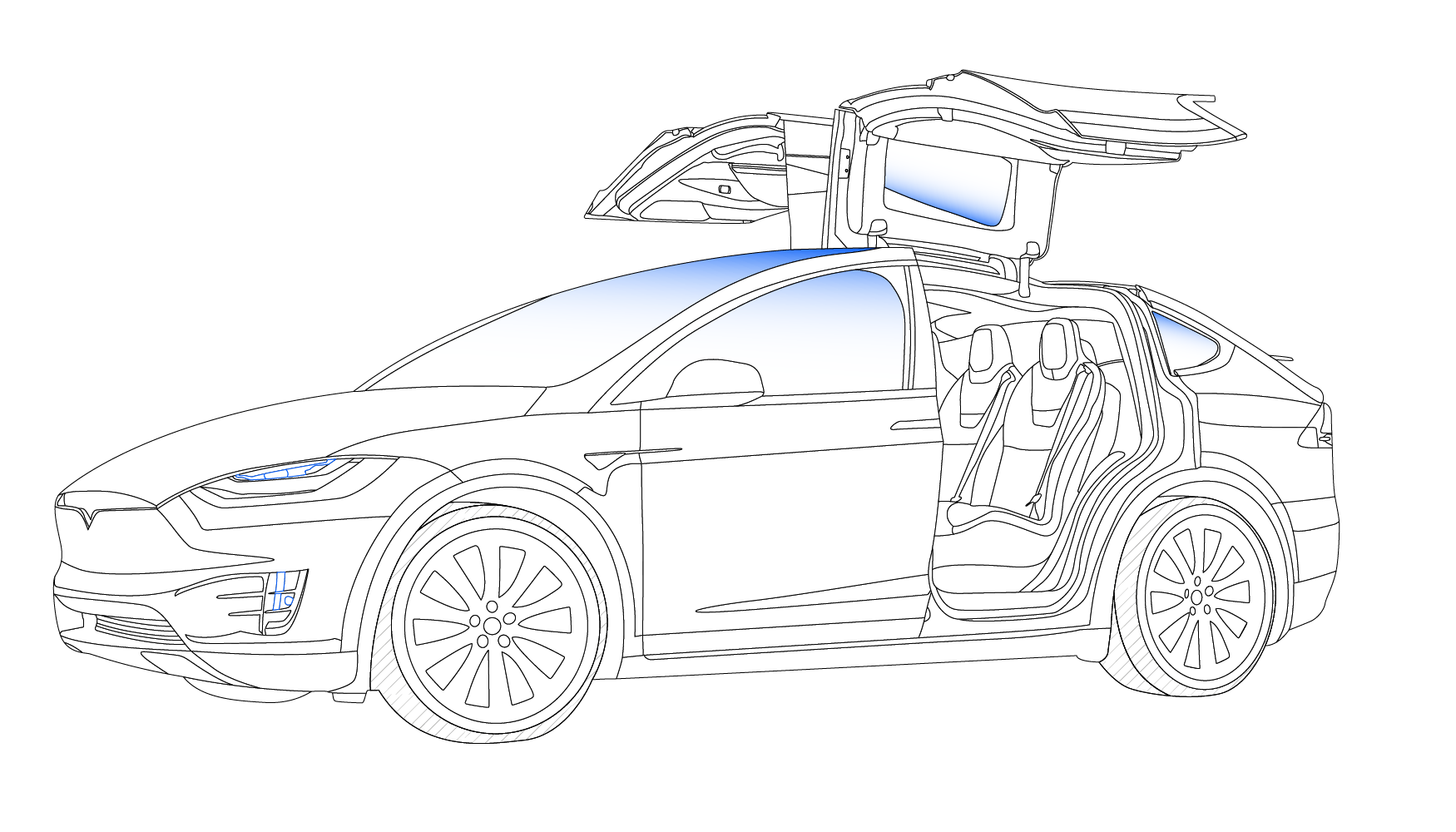

Watch The Tesla Model X SUV’s ‘Falcon’ Doors In Action Video, The price of the 2025 tesla model x starts at $81,630 and goes up to $96,630 depending on the trim and options. View detailed ownership costs for the 2025 tesla model x on edmunds.

Tesla Model X vs Tesla Model Y which Tesla SUV should you buy? TechRadar, Since the tesla model x is greater than 6000 lbs gvwr, it also qualifies for section 168 which can be far better than section 179. Frequently asked questions on tesla model x tax benefits.

Tesla Model X vs Tesla Model Y which Tesla SUV should you buy? TechRadar, Section 179 of the tax code states that vehicles with a gross vehicle weight rating (gvwr) of over 6,000 pounds are eligible for an immediate business tax deduction of up to $25,000. Tesla offers the 2025 model x in two flavors.

Tesla unveils its Model X SUV complete with falcon wing doors and 'bio, Since the tesla model x is greater than 6000 lbs gvwr, it also qualifies for section 168 which can be far better than section 179. Research the 2025 tesla model x with our expert reviews and ratings.

Tesla Model X front view Tesla Model X at CES. The Model X… Flickr, I understand that the vehicle needs to be used for. There is a lot of false information going around about gross vehicle weight being over 6,000 lbs.

Used 2025 Tesla Model X for Sale in Mesa, AZ (with Photos) CarGurus, Section 179 of the irs code can help you save money on your taxes, especially if you buy certain types of vehicles. I'm looking to gather opinions and usage of members on this forum who have a model x and have used (or are looking to use) section 179 for 2016.

Tesla Model X Improve Your Driving Experience, Section 179 is now limited to $28,900 for the model x, unlike past years where the full purchase price could be immediately depreciated. Frequently asked questions on tesla model x tax benefits.

Tesla Model X vs Tesla Model Y which Tesla SUV should you buy? TechRadar, Edmunds also has tesla model x pricing, mpg, specs, pictures, safety features, consumer reviews and more. Section 179 of the tax code states that vehicles with a gross vehicle weight rating (gvwr) of over 6,000 pounds are eligible for an immediate business tax deduction of up to $25,000.

Tesla boosts Model X and Model Y with improved range and faster, But would the model x also qualify for the $25,000 heavy suv section 179 deduction? This allows you to fill up certain tax brackets with.

My Tesla Motors Model X VIN0002 as launched by Elon Musk Flickr, Take advantage of the section 179 deduction to deduct the full purchase price of the tesla model x in the year of purchase, subject to certain limits. Frequently asked questions on tesla model x tax benefits.

The 2025 tesla model x true cost to own includes depreciation, taxes, financing, fuel costs, insurance,.

Travel Hiking WordPress Theme By WP Elemento